.webp)

.webp)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/M556YB7O3ND4RGRWI5J3S3EBSE.jpg)

Sunrise over Victoria Harbor in Hong Kong China cityscape (Unsplash)

Hear Alex Thorn share his take on "Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

Major digital assets plunged as the business day began in Hong Kong on Friday.

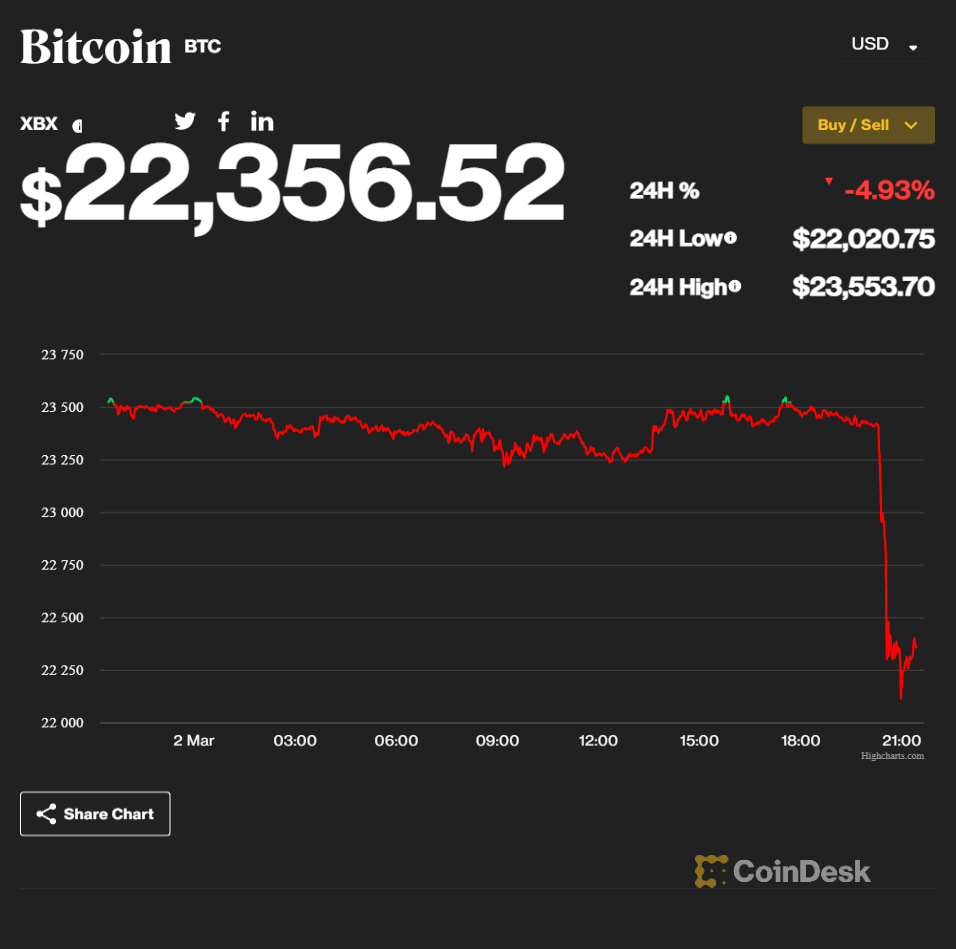

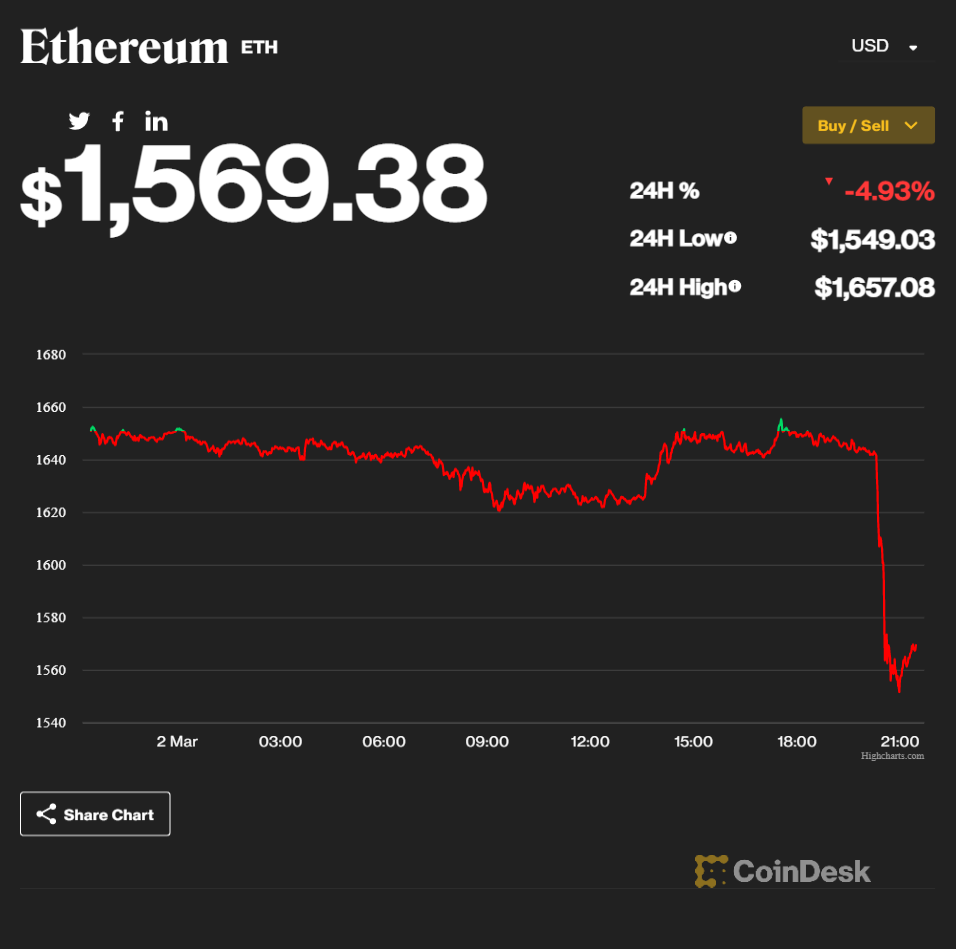

Bitcoin (BTC) and ether (ETH) both dropped more than 5% ascustomers fled crypto bank Silvergate, whose stock tumbled 58% during U.S. trading Thursday. Most of the other 10 largest cryptocurrencies by market cap saw declines similar to BTC and ETH's.

"Institutions are a bit jumpy as Silvergate seems to be having issues," Nick Ruck of ContentFi, a Web3 venture studio, said in a note to CoinDesk. Ruck also pointed to the release of some of Mt. Gox’s bitcoin, which would increase its circulating supply, as another source of volatility.

The rapid sell-off took a toll on major crypto exchange Coinbase, which began experiencing connectivity issues at 10:20 a.m. Hong Kong time. Other major crypto exchanges, including Binance, Bitfinex, Kucoin, OKX and Kraken, did not report similar issues.

Bitcoin’s price fell to an intraday low of $22,020 as Asia trading hours began, afterremaining roughly steady at $23,500for most of the past day. It appeared to rebound slightly, recovering to just under $22,400 following its plunge.

Ether saw a similar pattern, falling to $1,550 after spending the past day hovering around $1,650 with limited change.

Bitcoin’s market cap declined by over $20 billion to $431.9 billion, according to CoinMarketCap. Crypto's overall market cap is at $1.07 trillion. Open interest in bitcoin futures was down 8.8% in the last four hours,according to Coinglass. Open interest for ether was down 5%.

.png)