.png)

.png)

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/HESDQAXAMBBPVMWZYLTMUDUZUE.jpg)

U.S. Treasury Secretary Janet Yellen (Photo by Chip Somodevilla/Getty Images)

Bitcoin (BTC) continued its slightly downward consolidation on Tuesday, slipping just below $27,000 as investors kept close attention on the debt ceiling negotiations in Washington.

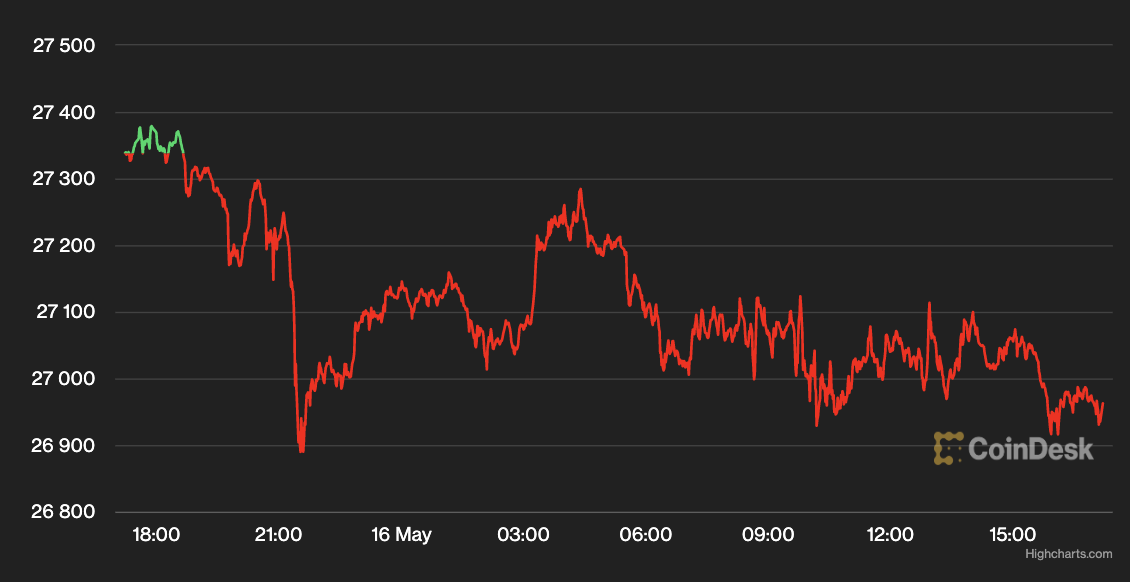

The largest cryptocurrency by market capitalization was recently trading at $26,950, down roughly 1.3% for the day, according to CoinDesk data. Over the past 24 hours, BTC’s price has been range-bound between $26,800-$27,400.

Bitcoin price chart showed that the cryptocurrency's price hovered below $27,000 on Tuesday. (CoinDesk)

While Treasury SecretaryJanet Yellen warnedthat the U.S. is projected to breach the debt limit as early as June 1 andsaida default “could lead to a recession,” several analysts believe a resolution to the debt ceiling issue could potentially buoy bitcoin.

“The current macroeconomic situation is, in our view, conducive for increased crypto adoption,” Joe DiPasquale, CEO of crypto fund manager BitBull Capital, told CoinDesk in an email. “The debt ceiling getting raised also bodes well for risk assets as market participants seek to secure wealth,” he added.

Lucas Outumuro, head of research at blockchain analytics firm IntoTheBlock, told CoinDesk that there “could certainly be a bid for BTC” whether or not there’s a deal on the debt ceiling.

Outumuro sees the impact of these negotiations and the ongoing bank crisis as similar: “They both highlight the weaknesses of the system and create doubts about their long-term sustainability, thus creating demand for potential alternatives like crypto.”

Ether (ETH), the second-largest cryptocurrency by market capitalization, slid 0.2% on Tuesday to change hands around $1,820. Among other digital assets,LDO, the governance token for the liquid staking platform Lido, continued Monday's strength to rise an additional 3%. Layer 2 blockchain Polygon’s nativeMATICtoken dropped by 2.8% to hover around $0.82 cents.

TheCoinDesk Market Index (CMI), which measures overall crypto market performance, was down 1.1% for the day.

.png)