<br />

<br />

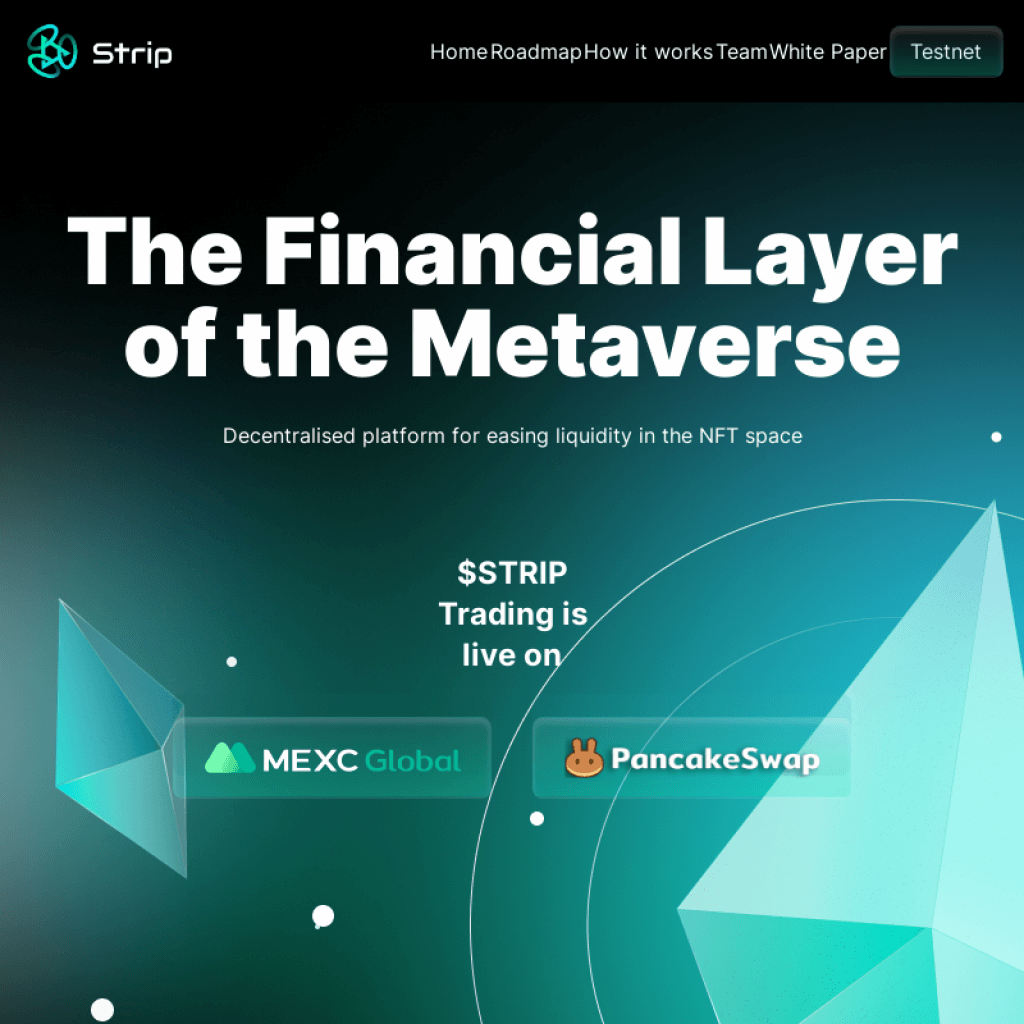

Mainnet Launch on BSC<br />

Native token $STRIP integration for governance, utility fee etc<br />

Support for other blockchains such as Solana, Matic, Polkadot, Wax, Hedera and more<br />

Enabling Cross Protocol bids for direct interaction into a single hub<br />

.png)

.png)

.png)